Will GOP Settle for a Clean Debt Limit Win?

No other legislative victories in sight

Both repelling and wallowing in a manufactured crisis are surefire ways for the Capitol to put itself in the headlines. That’s why some fresh drama fabrication is getting underway, even before the lawmakers have decided if their response will be crisply responsible or melodramatically craven.

This morality play will be about the federal debt, which is not going anywhere except up in the near term, no matter what anyone in Washington says or does to the contrary.

But that inevitability won’t forestall an enormous amount of political jawboning. And given the “Seinfeld” nature of the season ahead — it’s still shaping up to be a policymaking summer about nothing — rhetoric about the debt ceiling will draw more notice than at any time in the past six years.

The Republican majorities in the House and Senate have two possible storylines to advance.

They can sound the alarm about the looming catastrophe of the United States defaulting on its loans from creditors across the globe, then take credit for pushing through broadly bipartisan legislation defusing that threat — maybe even with plenty of time to spare.

Alternatively, they can impose all manner of blame on those previously in power, Barack Obama alone at the head of the list, asserting that they won’t bail out the Democrats and their perpetual addiction to red ink unless they can secure some ironclad future fiscal discipline in return.

GOP leaders look to keep that second scenario on the table for as long as possible, because it appeals to a swath of the party’s electoral base around the country; to many lawmakers who describe themselves as fiscal hawks on a theoretical level; and to that finite but intense group of confrontational conservatives propelled to power by the tea party wave.

But holding the government’s checkbook hostage to a unachievable goal will likely be abandoned in the end, because that hostile action is as politically risky and economically dangerous as it is apples-to-oranges inappropriate.

Last week, President Donald Trump, the real estate wheeler-dealer who proclaimed himself “the King of Debt” during last year’s campaign, essentially endorsed the keep-it-clean scenario.

The declaration was especially unusual given his stated interest in defying establishment Washington thinking. And, to be sure, this is a president with a well-demonstrated interest in changing his position whenever he imagines the situation calls for it.

Still, his initial taking of sides was almost entirely overlooked by a public transfixed with the legal and ethical clouds quickly thickening over his presidency, and so it could well get ignored by Republicans on the Hill eager to go their own way while Trump remains preoccupied by the constellation of problems that have put his White House under siege.

The sum of all borrowing

This is the centennial year of an anachronistic statute requiring Congress to set a cap on how much the government can have in outstanding obligations — the so-called debt ceiling. That means lawmakers are compelled to revise the law and increase the cap, or raise the debt ceiling, whenever borrowing reaches the limit.

Increasing the limit on borrowing has nothing whatsoever to do with deciding to spend more.

When Congress votes to raise the debt ceiling, it’s declaring its understanding that another wave of government bills are due — then making a commitment to paying them all on time and in full. But those invoices are all for government services dictated, and entitlement benefits approved, by Congresses controlled by both parties and endorsed by presidents of both parties over the course of many years.

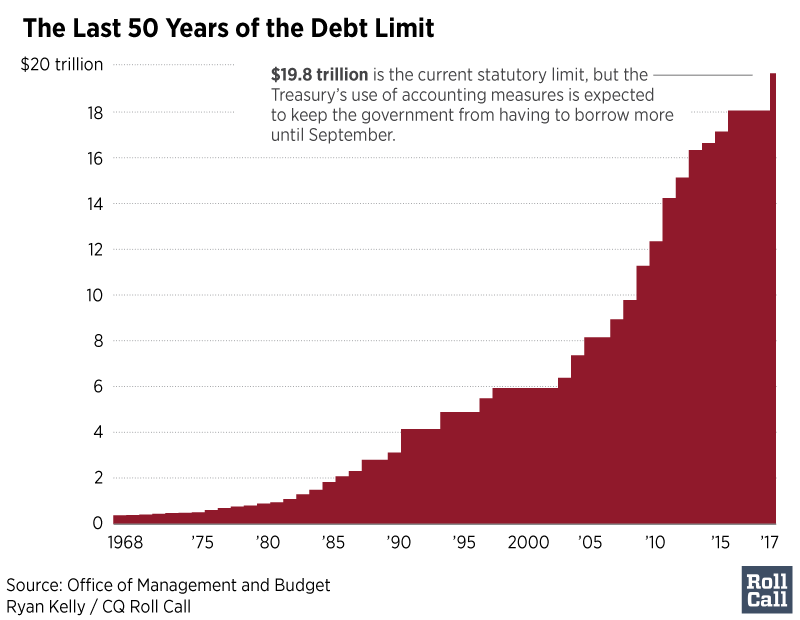

That’s because national debt, at a basic level, is the sum of all the borrowing necessary to cover the annual deficits the government has run in all but four of the previous 50 years, times when spending has exceeded tax revenue and the Treasury has had to sell interest-bearing bonds to bridge the difference.

So raising the debt limit is when today’s politicians promise to make good on the commitments of their predecessors.

Viewed that way, it’s easy to understand the position that fighting over future fiscal priorities should never be permitted to violate the trust that lenders around the world have put in the United States for decades in the past. In the same way, when a couple cannot agree whether giving up movie night or letting the lawn go unmowed is necessary to pinch a few pennies from their expense base, it makes no sense for them to express their anger at the impasse by refusing to pay their mortgage or keep current on their student loans. They have to service their debts to the banks every month, no matter how long they’re at loggerheads over corralling their creature comforts.

Trump effectively sided with those who would decouple the bill-paying from the budget-setting when he told GOP leaders at the White House that Treasury Secretary Steven Mnuchin would be the administration’s single point man on the debt. Mnuchin is pushing for a clean debt ceiling before investors start getting worried — duty-bound as he is to prevent a repeat of six years ago, when a debt standoff between Obama and House Republicans was bridged hours before a potential default, but the United States was punished with a credit rating downgrade anyway.

One of the congressmen in the vanguard of holding the debt hostage to legislated spending reductions that year was Mick Mulvaney, who’s now the White House budget director and has publicly advocated reprising that fight now.

Trump’s statement to the Hill leadership essentially pushed Mulvaney out of the debate, and the next day, his Cabinet colleague who had been a House soul mate in the 2011 budget wars, Health and Human Services Secretary Tom Price, told Congress he was totally behind a straightforward debt boost.

Speaker Paul D. Ryan told reporters last week that he has not committed to either the quick-and-clean or the confrontational approaches.

“I’m not foreclosing any option at this time,” he said, in part because GOP leaders have not concluded they can assemble a package of budget cuts that would secure support from 218 House Republicans.

Where are the votes?

As the health care debate showed, what the Freedom Caucus is demanding from the right is sometimes too much for the comparably-sized bloc of mostly suburban GOP lawmakers in the center.

And besides, whatever might get pushed through along party lines in the House would have even more trouble in the Senate. The debt ceiling can be increased by simple majorities in both the House and Senate as part of a budget resolution, but drafting a viable version of that document is proving highly problematic.

So it’s highly likely that a debt bill, with or without strings attached, would have to advance past a filibuster. That means support from eight Democrats, and there’s no sign those votes exist.

Whatever draws the support of that many Democratic senators in the current climate would probably win over another 30 of them, too. And that’s probably only one thing: a straightforward increase in the borrowing limit, one that also promised to draw a big bloc of GOP votes.

Almost every other country allows its debt to increase without any required affirmation from the government. And a persistent drumbeat from academics and some in Congress says the United States should join them, removing at last one balky piece from the already cumbersome budget machinery — and one that, should it fail and spawn a default, could produce economic havoc and raise the government’s cost of borrowing for generations.

But the countervailing argument has always won the day: If lawmakers are made to confront the consequences of past decision-making, they may get “scared straight” and adopt policies that start slowing the need for so much red ink.

The accumulated debt has steadily increased since 1969 and is now above $19.9 trillion. The Treasury is currently using some complex but legal accounting maneuvers to keep the government under the cap for several more months — September at the earliest, according to Mnuchin. It might even be later except for an unusual kink in the government’s cash flow: Tax revenue this year is at least $60 billion, or 2 percent, below projections — a consequence, most likely, of the wealthiest Americans deferring their IRS payments in the hopes of a tax cut before their extensions run out.

Trump and the GOP now see their health care aspirations idling in the Senate, their tax overhaul proposals stuck in first gear, their infrastructure plan still in the garage and the routine appropriations process in shambles in the body shop. A bill raising the debt limit with much less drama than usual stands a chance of becoming the first meaningful, and bipartisan, legislative vehicle to cross the 2017 finish line.