Who Benefits From the State and Local Tax Deduction?

Roll Call analysis finds higher-income earners reap substantial returns from the deduction

Corrected on Nov. 15 | A fight within the Republican Party over a proposal to eliminate the state and local tax deduction threatens the future of the GOP effort to overhaul the U.S. tax code.

Battle lines have been drawn, as lawmakers from states that see substantial benefit from the deduction — such as New Jersey and New York — are already sounding alarms at the proposal to remove it.

Democrats and even some Republicans say eliminating it would be a direct attack on the middle class.

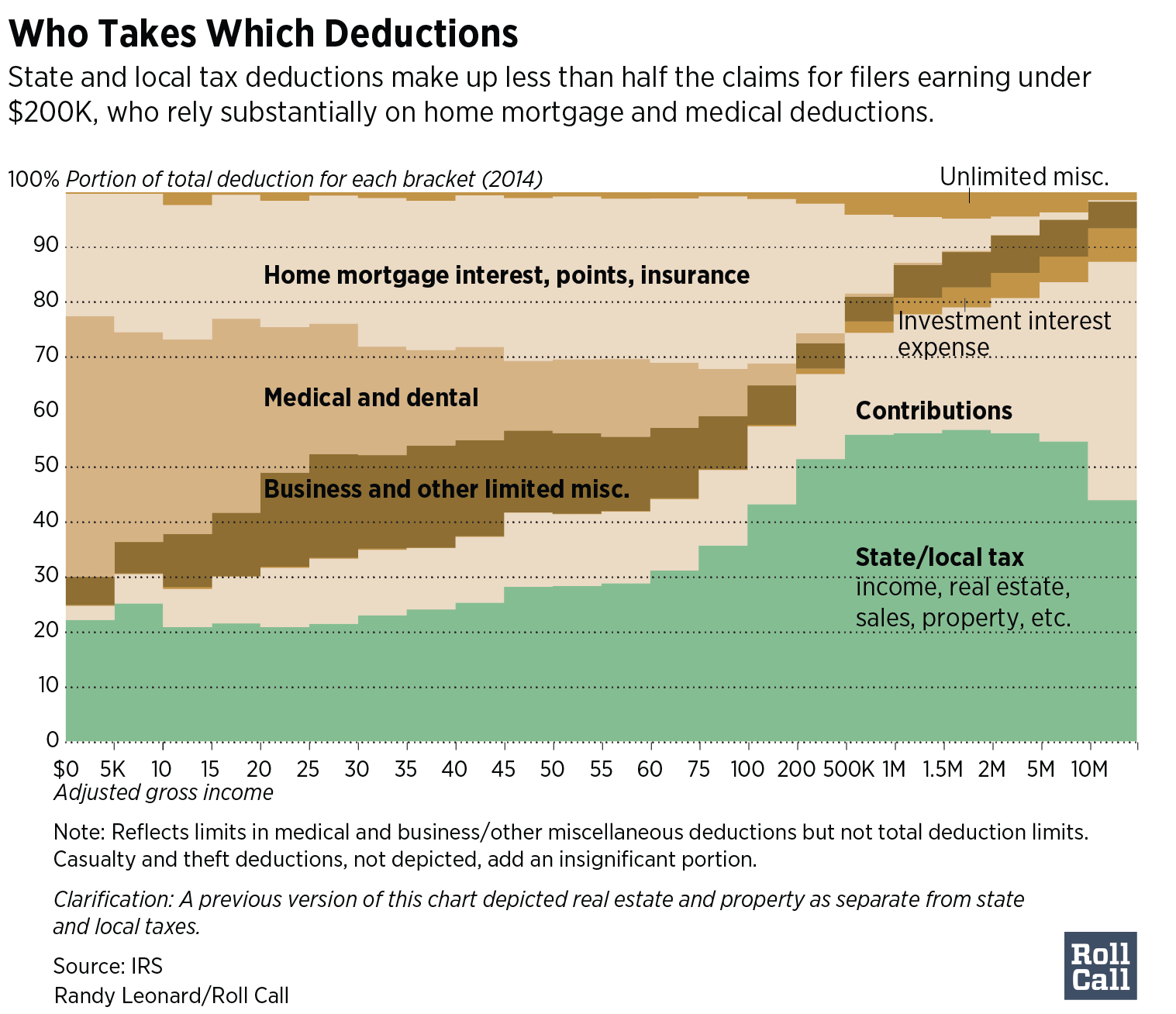

But while a portion of filers in the mid-tier income ranges use the deduction, a Roll Call analysis found that it primarily benefits higher-income earners. The analysis also found that the provision represents a smaller portion of the overall deductions typically claimed by the middle class.

“Whatever we do is going to have a lot of controversy,” Senate Finance Chairman Orrin G. Hatch said. “It’s not going to be easy no matter what we decide to do.”

Signs of that controversy are already playing out.

Some GOP lawmakers, such as Rep. Leonard Lance of New Jersey, voted against the House fiscal 2018 budget resolution — the vehicle to get to the tax legislation — because of the proposal to remove the deduction.

Ryan to Factory Worker: ‘We’re Going to Lower Your Taxes Yourself’

And as rhetoric flies from both sides of the debate, opinions are split over which income levels benefits most from it.

Republicans who support its elimination argue that it’s unfair for low-tax states to subsidize high-tax states, which they say are the main beneficiaries of the deduction. They say the tax code could be made more progressive with its removal, because the provision primarily benefits higher-income earners.

Some tax experts agree.

“I don’t believe it would be seen as middle-class tax relief if this didn’t exist and it was being proposed,” said Jared Walczak, senior policy analyst at the conservative-leaning Tax Foundation.

In contrast, Democrats call it an attack on the middle class.

“I think the proposal is a bad idea. It ends up being double taxation. But if you don’t believe me, talk to suburban, Republican congressman,” Pennsylvania Sen. Bob Casey said.

Analyzing the numbers

The truth may lie somewhere in the middle and could depend heavily on how one defines the middle class, a debate that still appears to be ongoing within the GOP.

While a sizable portion of mid-tier income earners capitalize on the deduction, the monetary benefit is skewed heavily toward higher-income earners, according to a Roll Call analysis of 2014 tax filing data from the Internal Revenue Service (the most recent year available).

Of the nearly 20 million people who filed tax returns and made between $50,000 and $75,000 a year, about 39 percent claimed the state and local tax deduction.

That percentage rose as income increased. In the $75,000 to $100,000 income range, nearly 55 percent claimed the deduction. Among households making between $100,000 to $150,000 a year, around 73 percent claimed it.

Tax filers making $150,000 and above overwhelmingly claimed the deduction.

But while filers in all tax ranges took advantage of the deduction, its benefit was felt the most among high-income earners.

Those using the deduction and making between $50,000 and $75,000 a year received an average benefit in their taxes of $3,800. That amount increased substantially as incomes went higher. Those in the $200,000 to $500,000 income range, for example, received a six times larger benefit — averaging about $22,600, before limits.

For high-income earners, the state and local tax deduction also represents a much larger portion of overall deductions. Mortgage interest and medical expenses typically represent a more substantial portion of total deductions for those making under $200,000, according to a review of IRS data.

“It does disproportionally impact higher-income individuals,” Pennsylvania Republican Sen. Patrick J. Toomey said of the deduction.

Democrats say removing the state and local tax deduction would be detrimental to middle-class households across the country.

“There are 44 million taxpayers who take the state and local deduction — that’s not a small number, that’s a third of all taxpayers,” Senate Minority Leader Charles E. Schumer said last week on the chamber floor. “Every state is affected, large numbers of people are affected in every state, and they are affected in a very deep way. Their taxes will go up significantly.”

Republicans counter that any negative impact on the middle class would be mitigated by plans to double the standard deduction and boost the child tax credit.

It is difficult to say exactly what the effect would be on each income class without detailed legislative language, which is not yet available. But there is some early support for that view, at least among many conservative groups.

“That certainly tracks with what one would expect,” Walczak said. “There are a number of benefits that would flow to the middle and the lower-middle class, probably even the upper-middle class, that might offset anything lost by the elimination of the state and local deduction.”

Regardless of the politics, however, some Republicans say changes to that deduction are inevitable.

“I think there’s general consensus that we are going to have to do something on that deduction to create some space to do some tax reductions in other areas,” Senate Republican Conference Chairman John Thune said.

Base broadening

One of the main reason Republicans want to remove the deduction is to help pay for the overall tax legislation.

Some outside estimates have pegged the removal as generating up to $1.4 trillion over ten years, a sizable portion that would help the GOP offset the tax cuts proposed elsewhere in their plan.

And paying for those cuts could mean life or death for the effort.

Lawmakers such as Sen. Bob Corker of Tennessee don’t want the tax package to add to the federal deficit, while others have said deficits are fine since the bill would ultimately be paid for through increased economic output.

If Republicans were to cave on removing the state and local tax deduction, it could make removing future deductions even harder and significantly complicate their ability to find a way to pay for their tax legislation — potentially delivering an early and fatal blow to the effort.

“None of the loophole closings are religion to me. What is religion to me is that we get $4 trillion of them done. So if you are going to throw that one aside, you’ve got [$1.2 trillion] to make up,” Corker said, referring to the estimated revenue gained from removing the deduction. “I don’t know how they get where they are going to go by giving up a [$1.2 trillion] pay-for.”

Asked if it makes finding additional offsets harder, the Tennessee Republican said, “Of course, are you kidding me?”

“If you don’t do this one, you’re not going to get there,” he added.

Corker’s recent Twitter brawl with President Donald Trump only increases the uncertainty surrounding the future of the tax overhaul legislation. With a Senate majority of 52, Republicans can afford to lose only two votes, prompting a tie-breaking vote from Vice President Mike Pence.

Correction: Calculations in a previous version of this article did not include real estate, personal property or other miscellaneous taxes in the overall state and local numbers. The current version has been changed to include all categories of state and local taxes.