Budget Committee Approves Tax Overhaul

GOP turns holdouts Corker, Johnson

Amid loud protest, the Senate Budget Committee passed Tuesday the tax overhaul reconciliation bill after two holdouts changed course.

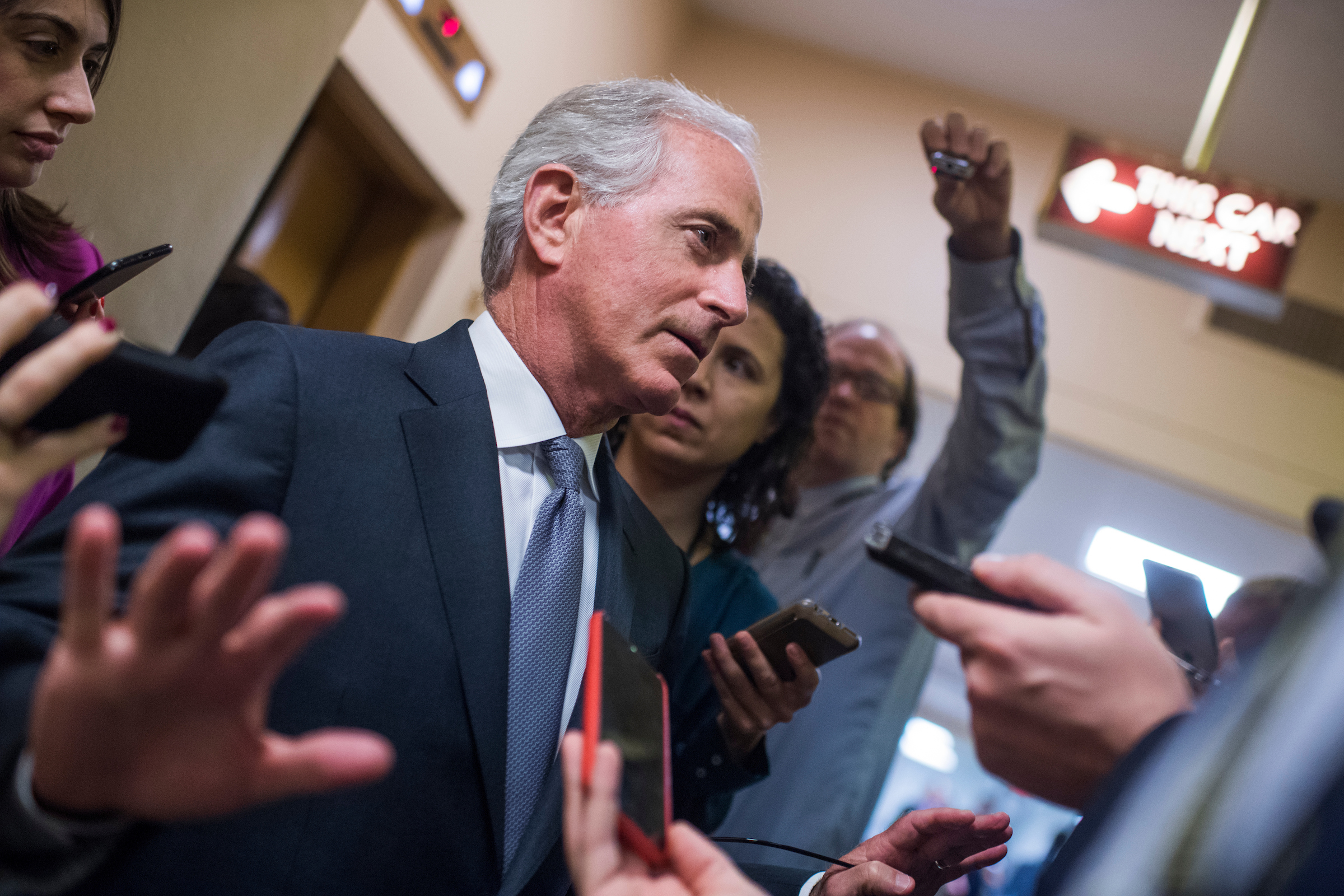

Sen. Bob Corker, one of the late holdouts voted yes. The Tennessee Republican cited an agreement in principle with Senate Majority Leader Mitch McConnell and Senate Finance Committee leaders on a “trigger” mechanism that would increase taxes if estimated growth projections do not materialize.

“We’ve got an outline of an agreement at every level that matters in the Senate to make it happen,” Corker said.

“I think we’ve come to a pretty acceptable place from my standpoint,” he said.

Sen. Ron Johnson who first announced his opposition to the measure earlier this month also changed his position, citing progress made on both the trigger idea and small business provisions. However, he suggested additional changes will be need to be made before he can commit to voting for the bill on the floor.

“I’ve still got very serious concerns about those pass-through businesses, often times the manufacturers that are so important to small towns. We need to make sure that as we make all businesses competitive globally, we don’t leave behind those pass-through businesses [and] maintain their competitive position and balance within our economy,” Johnson said on Fox News.

Johnson said he agreed to advance the measure out of the Budget Committee because President Donald Trump, who met with Senate Republicans at the Capitol Tuesday, promised his concerns would be addressed.

“When the President of the United States tells you that he’s going to fix your problem and he asks for your vote, I was more than willing to give it to him in [committee] here today,” he said.

The Budget Committee’s vote on the reconciliation bill, which combines the Finance Committee’s tax overhaul measure with the Energy and Natural Resource Committee’s bill to allow oil drilling in parts of Alaska’s Arctic National Wildlife Refuge, was quick but spirited as protesters gathered at the markup.

Watch: Protesters Chant ‘Kill the Bill’ as Tax Overhaul Advances From Senate Committee

The trigger proposal, which Corker said was finalized during a meeting of roughly five Senate Republicans after their weekly conference lunch and just before the Budget markup, appeared key to advancing the bill, which is expected to the Senate floor for a vote later this week.

Corker said he’d been meeting all morning Tuesday with Finance Committee members and talking to administration officials, including Treasury Secretary Steven Mnuchin and White House chief economic advisor Gary Cohn, throughout the weekend. He talked to Trump about the idea during the GOP lunch and said that General Kelly has kept the president apprised of discussions.

Details of the trigger proposal were not discussed during the conference luncheon as they were not finalized until afterward, Corker said, declining to reveal share details of the agreement with reporters.

An idea Sen. Ted Cruz raised during the lunch to include a trigger to cut taxes further if growth projections are better than expected was not included in the agreement, Corker said.

“We’ve got huge deficits,” he said. “I think the concern is not having enough revenue; it’s not having too much.”

Sen. James Lankford, another senator who had been advocating for the deficit backstop, declined to share the preliminary ideas of what tax increase the trigger would cause as he headed into the GOP lunch.

But Freedom Caucus Chairman Mark Meadows said later Tuesday he spoke with Lankford that morning and the idea what being discussed at that time was a trigger that would increase the corporate rate from 20 percent to 21 percent after five years if growth over that time did not average 0.4 percent per year. It was unclear if that proposal was the one Corker, McConnell and Finance leaders agreed on later that afternoon.

The growth projection of 0.4 percent per year Republicans frequently tout is unlikely to be reflected in any static score of the bill. Thus an official Joint Committee on Taxation estimate would likely assume the trigger takes effect and thus project it as raising revenue.

Lankford said lawmakers wouldn’t use any revenue the trigger raises to offset other tax changes.

“No, because we hope it would never be used,” he said. “The design of a backstop is that it would never be used.”

Paul Krawzak contributed to this report.