Familiar offsets could resurface in spending caps talks

Budget watchdog groups start to dust off older proposals, as well as some new ones

Another year, another spending caps negotiation — accordingly it’s time once again to check the couch cushions for “pay-fors” just innocuous enough to skate by without kicking up too much lobbying dust.

For instance, extending automatic cuts to Medicare and dozens of other “mandatory” spending accounts, which have become so routine they’re almost unnoticed, has been a mainstay of all three deals in the last five years to relieve the pressure on appropriators. Extending fees collected by Customs and Border Protection on passenger and cargo arrivals in the U.S., first enacted in 1985, has been rolled over constantly as a go-to offset for all manner of legislation, including the 2013 and 2018 spending deals.

And lawmakers just need to divert some of the fees tacked into airline ticket sales by the Transportation Security Administration into the general fund of the Treasury. They don’t even need to increase those fees — and likely won’t due to the airline industry’s lobbying clout.

Those are just a few examples of the $268 billion in cuts, fees and other revenue-raisers that policymakers have squeezed out of various stakeholders in three spending caps deals over the last five years, a CQ Roll Call tally found. As a result, lawmakers and successive administrations have cut the net 10-year cost of the pacts reached in 2013, 2015 and 2018 by 53 percent.

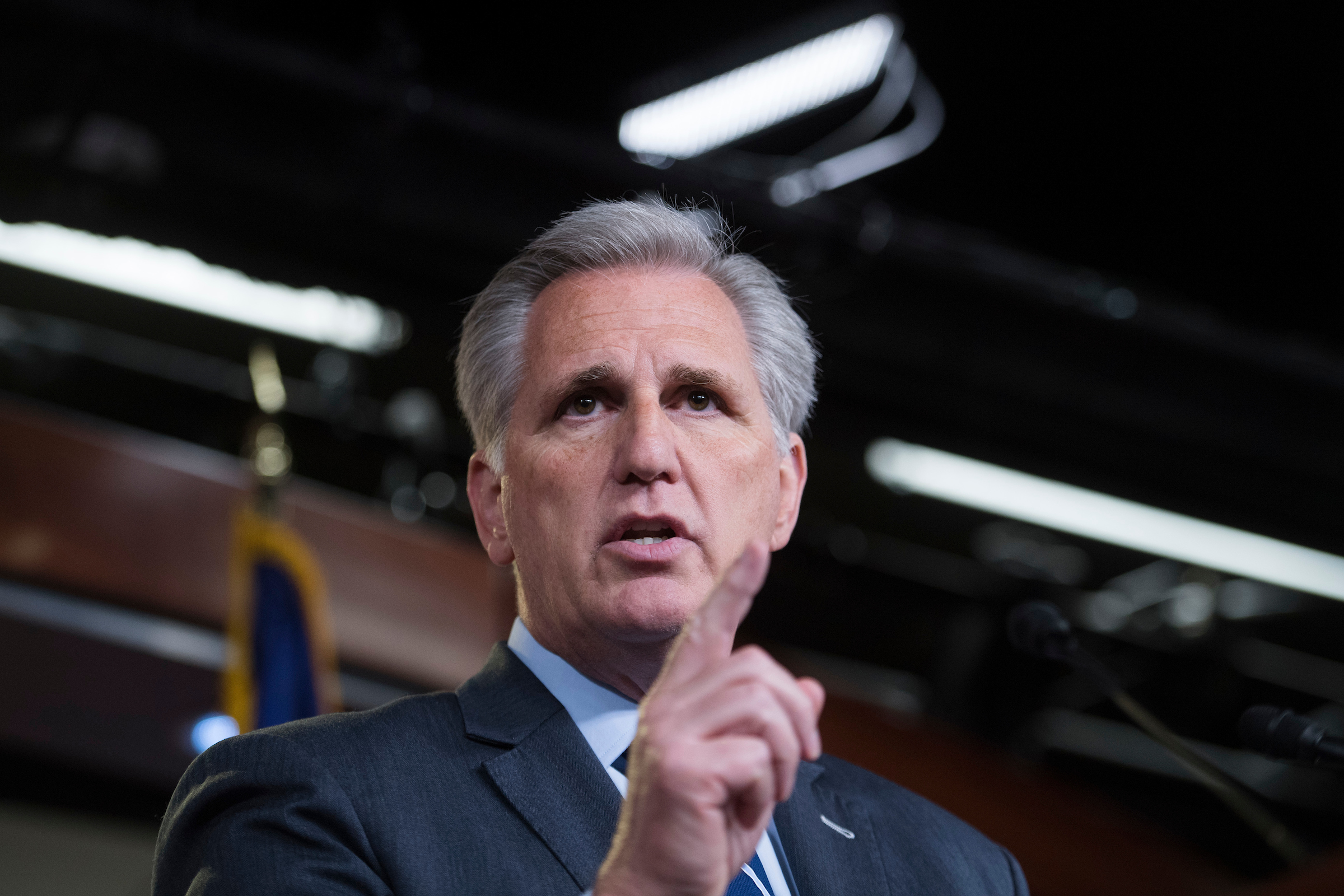

“There’s always been offsets for any cap increase,” House Minority Leader Kevin McCarthy said after a June 19 meeting between top Hill and White House officials on discretionary spending limits.

But not all budget deals are created equal when it comes to offsets. The first two accords, in 2013 and 2015, were fully offset and then some, trimming a net $17 billion from 10-year deficits. The 2018 deal, enacted under all-GOP control of the legislative and executive branches, is by far the priciest — clocking in at a hefty $358 billion in gross costs over a decade. Only about 29 percent of that cost is offset, though $90 billion in emergency disaster relief funds isn’t included in those calculations.

And that was shortly after the Republican Congress and President Donald Trump pushed through a tax cut plan in late 2017 that was estimated at the time to cost $1.5 trillion over a decade, even after offsets. Against that backdrop, House Democrats aren’t keen to offset higher nondefense discretionary spending.

On top of $296 billion in two-year cap increases in the 2018 deal, the package included about $62 billion in mandatory health care and agriculture spending as well as tax breaks. The way the package was designed enabled each side to claim a policy win; the $103 billion in total offsets included $57 billion that weren’t specifically for health care or agriculture programs, but could be cited as paying for both the $18 billion in tax extenders and a portion of the discretionary spending increases.

Similarly, another budget negotiation this year is likely to attract riders that would have more difficulty passing on their own, including another tax extenders package.

Also watch: What’s a continuing resolution?

Smaller ambitions?

It’s not entirely clear yet whether a deal to raise tight appropriations limits for the fiscal year beginning Oct. 1, and possibly for fiscal 2021, can be struck. There also is the chance Congress and the White House could end up with a one-year stopgap to continue spending at fiscal 2019 levels, if they are unable to reach an agreement to raise the caps. Top White House officials suggested that approach as a fallback during their meeting with congressional leaders last Wednesday.

But budget watchdog groups are starting to dust off older proposals, as well as some new ones, in case the offsets discussion perks up.

In a paper released last week, the nonpartisan Committee for a Responsible Federal Budget proposed hundreds of billions of dollars in spending cuts, tax increases and other changes to federal programs to fully offset any caps increase.

The most likely offset included in the CRFB list is an extension of the automatic cuts to mandatory programs, including Medicare and farm subsidies. The cuts were first imposed in fiscal 2013, at the same time as the discretionary spending cuts under the 2011 deficit law.

They were supposed to end after fiscal 2021, just like the tighter spending caps, but lawmakers have continually extended the mandatory cuts because they proved negligible enough — Medicare cuts are limited to 2 percent, for instance — that lawmakers and stakeholders alike deemed them acceptable in order to help preserve higher discretionary spending. The cuts have now been extended to fiscal 2027, including for two years as part of the 2018 budget deal, saving about $35 billion, according to the Congressional Budget Office.

More offsets

The expiration dates for some of the offsets in the 2018 spending deal are instructive. At the time, the 10-year budget window used by the CBO to “score” legislation ended in fiscal 2027. Negotiators extended several offsets into the final year of that budget window, generating funds that would show up in the score and thereby make the cost look smaller.

Besides the automatic cuts, or sequester, of mandatory programs, provisions extended into fiscal 2027 as part of the 2018 budget deal or in subsequent legislation include the following:

- Customs user fees charged on the arrival in the U.S. of commercial vessels, trucks, railroad cars and aircraft, as well as special merchandise processing fees; estimated to raise $8.5 billion for extensions of one to two years, depending on the fee.

- A two-year extension of the diversion of excess aviation security fees charged to air travelers out of TSA coffers once they’ve covered their own costs, into the Treasury general fund; scored as raising $3.3 billion.

- Sales of 100 million barrels of crude oil out of the Strategic Petroleum Reserve were authorized through fiscal 2027, raising almost $6.4 billion. Current projections show the reserve will be down to about 400 million barrels in storage at the end of fiscal 2027, or 60 million away from its statutory minimum, but lawmakers could authorize selling off the remainder and generate more than $4 billion under the CBO’s current oil price forecasts for fiscal years 2028 and 2029. But Senate Energy and Natural Resources Chairwoman Lisa Murkowski has opposed selling more of the oil unless to reinvest the proceeds in modernizing storage facilities, so this option may be a heavier lift.

- Extending visa processing fees for high-tech workers and others for two years, raising almost $1.6 billion. Congress could also consider increasing the fees charged for applications to bring in nonimmigrant workers under H-1B and L-1 visas. The last fee increases were enacted as an offset in late 2015, the last time lawmakers put more money into the September 11th Victim Compensation Fund — something they are currently considering again this year.

The CRFB also notes support in past budget deals for increasing premiums paid by employers to the Pension Benefit Guaranty Corporation to insure their pension plans against default. The 2015 spending cap deal generated more than $8 billion in 10-year savings through pension-related changes.

Marc Goldwein, senior vice president at the CRFB, also thinks there is “very strong bipartisan support” for proposals aimed at lowering prescription drug costs and ending surprise medical bills, which his group says could save $20 billion. Another proposal that has floated around for years would equalize Medicare payments to hospital-owned physician clinics with those paid to physician offices, which Goldwein’s group estimates could save another $15 billion.